There are some similarities and differences between a limited liability partnership and a one person company. Choose your firm type based on your needs and expectations for your business. Both types of firms have a lot of advantages and some disadvantages. LLP Registration and OPC Registration can be done through e-form. We will encourage you to pursue your dreams and JustStart will fully support you with its expert consultancy services.

What is the difference between a One Person Company and a Limited Liability Partnership firm?

An OPC is well defined by its unique name, which states that it is a One Person Company. This is the best option for small businesses as it is run by a single person. A One Person Company is incorporated under the provisions of the Companies Act, 2013. It is registered by ROC.

Whereas a Limited Liability Partnership firm must have at least 2 partners, there is no limit on the maximum number of partners. The liabilities of the partners are limited by this firm, which means at the time of any mishap, the personal assets of the partners will not be affected. An LLP is incorporated under the provisions of the Limited Liability Partnership Act, 2008.

Similarities and Dissimilarities of OPC and LLP

-

Members

The owner of a One Person Company is the only member. Although the owner may employ several employees to oversee the operations of the company, 100% ownership would be held in only one hand.

However the Limited Liability Partnership firms can have a minimum of 2 partners, and there is no limit on the maximum number.

-

Capital

Both One-person companies and limited liability partnerships do not require any specific amount of capital for their companies.

-

Compliances

In comparison to LLP, OPC has a higher level of statutory compliance. However, various penalties are prescribed for both OPC and LLP in case of non-compliance.

-

Audit Requirements

Audit is mandatory in a One Person Company, irrespective of its share capital, directors, and members. Whereas in LLP, an audit is mandatory only when the turnover exceeds the limit of Rs 40 lakh and the share capital exceeds Rs 25 lakh.

-

Tax Payable

The corporate tax rate of an LLP is around 30% whereas for an OPC it is around 25

-

Inheritance Entity

LLP has a separate legal entity. It has perpetual succession, which means the company will continue its existence irrespective of any insolvency of any of its partners.

A One Person Company also has a separate legal entity but mandatorily requires a nominee (with his consent) at the time of incorporation of the company.

One Person Company Registration

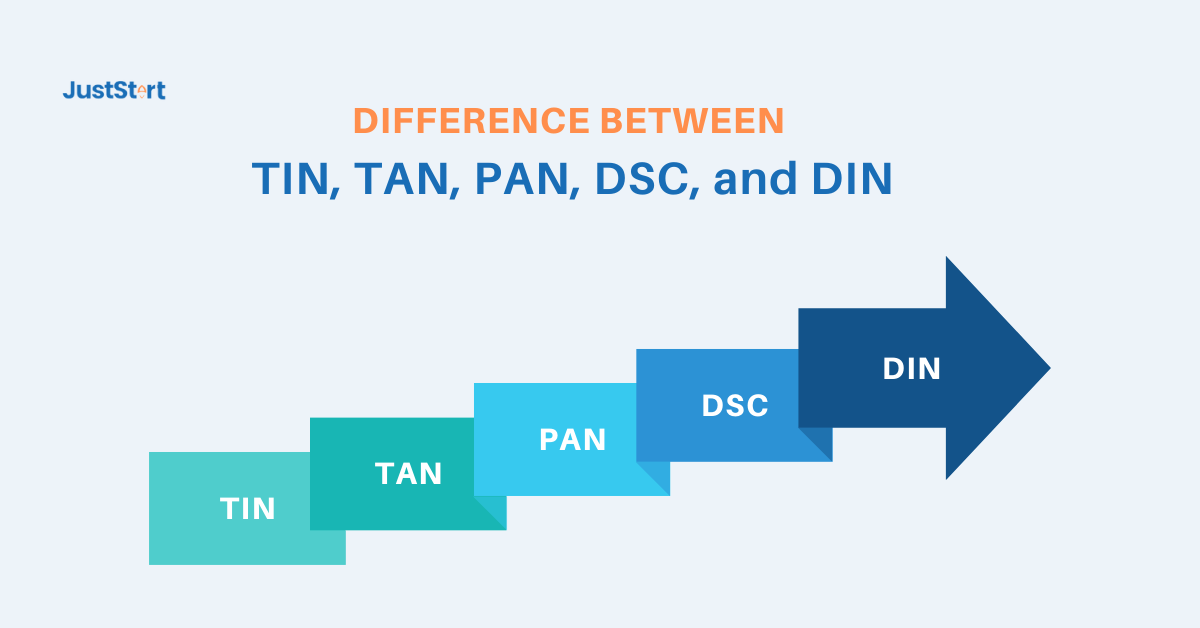

Step 1: Request a DSC

In One Person Company Registration, you have to first apply for the Digital Signature Certificate (DSC) along with the Digital Identification Number (DIN) of the director/member. It is mandatory for OPC registration.

Step 2: Name Approval

Name approval of the company would be done by filling up the Spice+ 32 form on the website of the Ministry of Corporate Affairs (MCA) itself. If your approached name gets rejected, you can even re-apply by filling out the same Spice+ Part-A form.

Step 3: Required Documents

One Person Company online registration requires all the KYC documents with the proposed fees.

- Passport size photo,

- Copy of ID and E-mail ID

- Phone number, Specimen Signature

- Address proof of the registered company with NOC (if rented).

Step 4: File Spice+ Part-B Form

All documents are required to be up-to-date while filing the e-forms. It includes INC-32, 33, and 34. OPC online registration also requires ID proof, address proof, and a digital signature certificate of the subscriber and the nominee.

Step 5: Certificate of Incorporation

After going through all your documents and data, the registrar will approve your request for the company’s incorporation. Furthermore, MCA will issue a Certificate of Incorporation.

Limited Liability Partnership Registration

Step 1: Apply for DIN or DPIN

Apply for each part's digital Identification Number or Digital Partners’ Identification Number. It could be easily done with the e-form.

Step 2: Registration on the Portal

Register yourself in the suitable category for the LLP Registration. A Digital Signature Certificate is also required in the process of signing off. You will be provided access to the e-forms.

Step 3: Name authorization

Use Form-Fillip to bring forward your proposed names for your LLP. Proceed to the next step if the name gets approved.

Step 4: Required documents

Every document required is of all the proposed partners for LLP Registration.

- PAN Card, ID proof

- Partners’ address proof

- Passport size photo

- Email and phone number

- Registered office address with NOC (if the office is in a rented place)

Step 5: Certificate of Incorporation

After all the checking of your documents, you will be provided a Certificate of Incorporation by the Ministry of Corporate Affairs.

Step 6:Agreement

In this process, provide all the agreed terms in the agreement of your LLP. Prepare and file it within 30 days. It could be done with the help of a CA, CS, or any authorized expert.

List of before LLP Registration and OPC Registration

At the time of OPC registration, make sure of the eligibility criteria of the nominee, which is 18+ and with full consent. The owner too can’t be a minor. The owner should be an Indian citizen or an NRI.

At the time of LLP Registration, at least one partner has to be an Indian resident and a citizen. All the partners must be 21+ and a minimum of 2 partners is required. While making the LLP agreement, the consent of all partners is necessarily required. The capital contribution must be decided earlier. All partners’ documents must be clear.

Highlight Comparison between LLP V/S OPC

Both of these firms provide ease in marketing. Preferring a business type completely depends on one’s requirements. However, a Limited liability partnership is a preferred idea because it provides the beneficiaries of both private limited and partnership firms. Also, no partner is liable for any mishappening done by another partner. Whereas a One-Person Company works well for small businesses due to its simple work mechanism.

JustStart is here to assist you with all counseling services. We offer our specialized skills to our clients. Once you connect us, it becomes our responsibility to serve you in the best have! For more information or any queries, feel free to contact us.